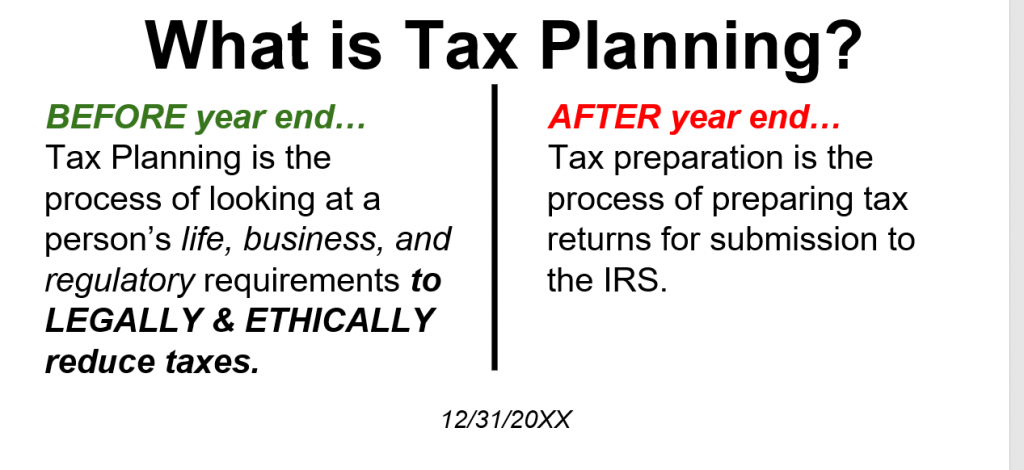

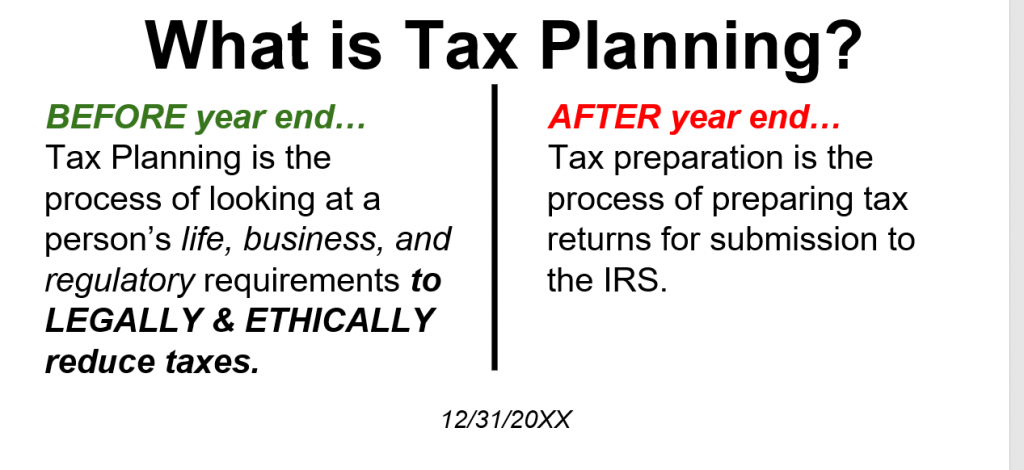

What Is Tax Planning

Discover How You Can Stop Loosing Tens of Thousands In Taxes Legally & Ethically Even If You Have a CPA

In 2010, I began developing tax strategies for the one owner and married couple-owned business and over the years have spent over $100,000+ learning Tax Planning from Top Tax Planning Experts in the country. Today I have more than 750+ Businesses with sales as low as $500k to as much as $52M who have benefited from the tax-saving advice in my programs.

Tax Planning is the processing of going through about 60,000 pages of Tax Code and finding each and every strategy applicable to your Business allowed by Law. In other words, a process of aligning your Business with the Tax Code in the most efficient way to help you as the Business owner achieve the goals and objectives for your Business.

The one question I often get asked is “Why do I need your Tax Planning, Anshul? My accountant will know all these things, right?“

No, and here’s why: Most business owners hire a tax preparer. But there’s a MAJOR difference between a tax preparer and a TAX PLANNER. A tax preparer tells you how much you “OWE” versus a Tax Planner that can tell you how much you can “SAVE”.

In other words, a tax preparer will tell you how much taxes you need to pay and stay compliant while a Tax Planner is a strategist that finds all the legally available tax strategies to help you lower your tax bill.

Plus, your accountant is busy 50 to 60 hours a week (more during tax season) preparing client tax returns, doing audits, helping clients negotiate loans, and a zillion other things. The only tax education most practicing CPAs get is the occasional tax seminar they attend, maybe one or two during the year.

By comparison, we are mainly a tax planning firm. I spend 100 to 130 hours a month researching, studying, and writing about IRS regulations and changes in the tax code. So I have the luxury of keeping current with all the myriad opportunities there are for you to slash your tax payments and save money.

- How You Can Rent Your Personal Home To Your Business Income Tax Free

- 4 factors that determine whether you should buy or lease your next business vehicle

- How you can save big tax dollars by hiring your dependent children as young as 7 years in your business

- A little-known secret that qualifies you for the home-office deduction even when you have your regular office

- LLC, C corporation, S corporation - which is best for you after Tax Cuts & Jobs Act was Passed In 2018.

- How to slash social security and Medicare taxes

- How to hire your spouse without paying payroll taxes

- Accelerate your depreciation deduction of your real estate properties up to eightfold

- How you can move assets out of your Estate via Estate Tax Planning

- How your Business can qualify for some commonly missed Tax Credits that can amount to thousands of dollars and we can go back 3 years to claim them.

- How your Business can Maximize Section 199A (Phantom) Deduction simply by paying yourself the correct amount of Salary

- Get a 100% deduction for partying with your employees

- An easy way to deduct the cost of your commute to and from work

- 36 items in your building that can be depreciated like equipment

- 6 common immunities from the “no deduction” rules for entertainment facilities

- How to deduct groceries as a business expense

- How to deduct up to 90% of the cost of your car

- How one taxpayer deducted landscaping and lawn care and you might too

- 8 ways to maximize your home office deductions

- Will the IRS let you deduct the cost of getting your shirts laundered after you return from a business trip? The answer may surprise you

- How to deduct the cost of transportation on your private plane as a business expense

- How to deduct the cost of a motor home

The above are just basic tax planning strategies. I go over some of the advanced strategies in my E-book “TOP 100 POWERFUL TAX PLANNING STRATEGIES FOR BUSINESS OWNERS!” If you want, I’ll be happy to provide a copy of it during your Free Tax Assessment.

© 2022 For information, contact Shah & Associates CPAs PA

What Is Tax Planning

Discover How You Can Stop Loosing Tens of Thousands In Taxes Legally & Ethically Even If You Have a CPA

In 2010, I began developing tax strategies for the one owner and married couple-owned business and over the years have spent over $100,000+ learning Tax Planning from Top Tax Planning Experts in the country. Today I have more than 750+ Businesses with sales as low as $500k to as much as $52M who have benefited from the tax-saving advice in my programs.

Tax Planning is the processing of going through about 60,000 pages of Tax Code and finding each and every strategy applicable to your Business allowed by Law. In other words, a process of aligning your Business with the Tax Code in the most efficient way to help you as the Business owner achieve the goals and objectives for your Business.

The one question I often get asked is “Why do I need your Tax Planning, Anshul? My accountant will know all these things, right?“

No, and here’s why: Most business owners hire a tax preparer. But there’s a MAJOR difference between a tax preparer and a TAX PLANNER. A tax preparer tells you how much you “OWE” versus a Tax Planner that can tell you how much you can “SAVE”.

In other words, a tax preparer will tell you how much taxes you need to pay and stay compliant while a Tax Planner is a strategist that finds all the legally available tax strategies to help you lower your tax bill.

Plus, your accountant is busy 50 to 60 hours a week (more during tax season) preparing client tax returns, doing audits, helping clients negotiate loans, and a zillion other things. The only tax education most practicing CPAs get is the occasional tax seminar they attend, maybe one or two during the year.

By comparison, we are mainly a tax planning firm. I spend 100 to 130 hours a month researching, studying, and writing about IRS regulations and changes in the tax code. So I have the luxury of keeping current with all the myriad opportunities there are for you to slash your tax payments and save money.

- How You Can Rent Your Personal Home To Your Business Income Tax Free

- 4 factors that determine whether you should buy or lease your next business vehicle

- How you can save big tax dollars by hiring your dependent children as young as 7 years in your business

- A little-known secret that qualifies you for the home-office deduction even when you have your regular office

- LLC, C corporation, S corporation - which is best for you after Tax Cuts & Jobs Act was Passed In 2018.

- How to slash social security and Medicare taxes

- How to hire your spouse without paying payroll taxes

- Accelerate your depreciation deduction of your real estate properties up to eightfold

- How you can move assets out of your Estate via Estate Tax Planning

- How your Business can qualify for some commonly missed Tax Credits that can amount to thousands of dollars and we can go back 3 years to claim them.

- How your Business can Maximize Section 199A (Phantom) Deduction simply by paying yourself the correct amount of Salary

- Get a 100% deduction for partying with your employees

- An easy way to deduct the cost of your commute to and from work

- 36 items in your building that can be depreciated like equipment

- 6 common immunities from the “no deduction” rules for entertainment facilities

- How to deduct groceries as a business expense

- How to deduct up to 90% of the cost of your car

- How one taxpayer deducted landscaping and lawn care and you might too

- 8 ways to maximize your home office deductions

- Will the IRS let you deduct the cost of getting your shirts laundered after you return from a business trip? The answer may surprise you

- How to deduct the cost of transportation on your private plane as a business expense

- How to deduct the cost of a motor home

The above are just basic tax planning strategies. I go over some of the advanced strategies in my E-book “TOP 100 POWERFUL TAX PLANNING STRATEGIES FOR BUSINESS OWNERS!” If you want, I’ll be happy to provide a copy of it during your Free Tax Assessment.